Are you in possession of a house that you’re considering selling? Perhaps the idea of seller financing has crossed your mind. However, if you currently have a mortgage on the property, you might be curious about the possibility of engaging in owner financing in Oroville. This question arises frequently, and to address it, we’ve chosen to provide a comprehensive answer in this blog post. By continuing to read, you’ll gain insights into whether owner financing is feasible in your situation, along with some strategies to help you proceed effectively.

You have options

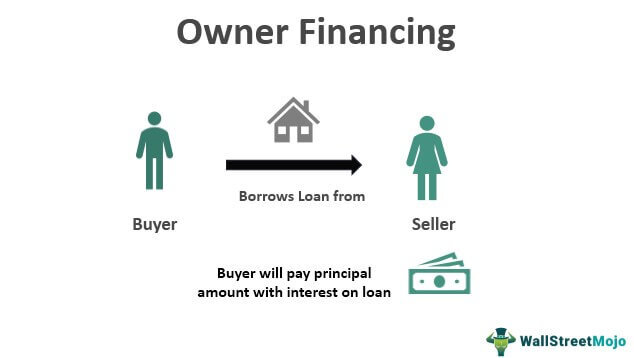

Homeowners contemplating the sale of their property have various avenues to explore. They can engage a real estate agent to list their home, opt for a self-listing approach, or directly sell to a buyer. Moreover, an increasingly popular strategy called “owner financing” or “seller financing” has emerged, offering a straightforward method to sell a home while receiving regular payments towards the house’s payoff:

- The buyer provides a down payment.

- The buyer makes regular monthly payments.

- Once the agreed-upon price is fully paid, the title transfers to the buyer.

Homeowners find this approach appealing as it offers an excellent selling opportunity and attracts a wider range of buyers, including those who may not qualify for traditional bank financing. Buyers also benefit from the flexibility this strategy provides, expanding their choices without necessarily impacting their credit score.

If you own your house outright, you can proceed with a seller financing agreement. However, if you have an existing mortgage, you might wonder, “Can I engage in owner financing in Oroville if there’s a mortgage on the property?”

The short answer is: it’s a complex matter.

Seller financing with a mortgage

Certain states allow the establishment of a financial arrangement known as a “wraparound mortgage.” This involves extending a mortgage to a buyer, typically at a higher interest rate, while continuing to make your own mortgage payments to the bank. It’s important to note that this practice is not universally legal across all states and circumstances, and there are additional clauses and considerations that require your attention.

Can I Do Owner Financing if I Have a Mortgage on the Property? – You have choices

If seller financing is not feasible due to an existing mortgage, there are alternative options available to you.

One potential alternative is known as rent-to-own, which shares similarities with seller financing, such as ongoing payments and eventual ownership of the house. However, there are some notable differences. For instance, a down payment may not be required, and the buyer would need to qualify for a mortgage from a bank at the conclusion of the pre-established rental term.

If you are considering owner financing but still have a mortgage on your property, there is another option for you: Reach out to us and discuss your property with our team. As experts in real estate buying and selling, we possess knowledge of various alternatives that you may not be aware of. We can guide you through those options and provide assistance directly or connect you with someone who can assist you effectively.