In response to the dynamic changes in the economy, homeowners are now discovering an array of new opportunities to sell their properties that were previously unavailable. The conventional approach of relying solely on a real estate agent is no longer the sole option. Instead, homeowners now have the flexibility to explore alternative methods, such as selling their property independently or even considering seller financing as a viable option. If you find yourself contemplating of the process to sell a house by owner financing, this blog post will serve as an invaluable resource, providing you with a comprehensive, step-by-step guide that will navigate you through the entire process.

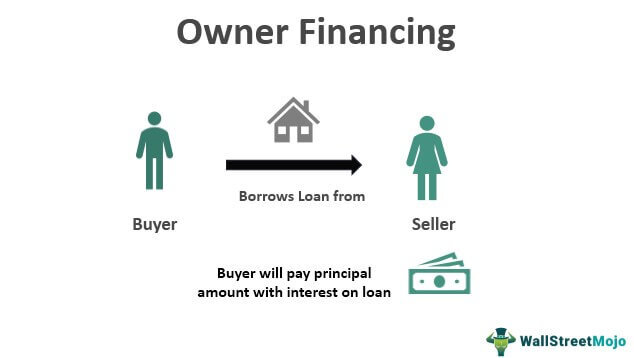

One notable option gaining popularity is the ability to sell a house on your own. By bypassing the involvement of a real estate agent, you can assume direct control of the selling process. This approach offers various benefits, including increased flexibility, a more personalized experience, and the potential to save on commission fees. Another alternative worth considering is seller financing. This method allows you, as the homeowner, to act as the lender and offer financing options to potential buyers. Essentially, you become the bank, allowing buyers to make payments to you directly, instead of securing a traditional mortgage from a financial institution. Seller financing can attract a broader pool of buyers, including those who may not qualify for conventional loans, thus expanding your potential market.

If you’re intrigued by the idea of owner financing and wish to explore this route, it’s crucial to understand the step-by-step process involved. The following sections will guide you through each stage, ensuring you have a clear understanding of what to expect and how to proceed. From educating yourself about legal requirements to assessing the property’s value, preparing it for sale, marketing to potential buyers, negotiating terms, and completing the legal documentation, this guide will equip you with the knowledge and understanding to successfully navigate the process of how to sell a house through owner financing in Butte County.

Step 1. Determine whether you own the house outright or still have a mortgage

Before proceeding with owner financing, it is crucial to determine whether you have a mortgage on your property, as the regulations regarding owner financing can vary between states. While some states allow homeowners with mortgages to offer owner financing, others have restrictions in place. Therefore, the initial and essential step is to ascertain your mortgage status.

Step 2. Talk to a real estate attorney for help in crafting an agreement

By opting for seller financing, you assume the role of a financial institution, akin to a bank. The buyer will provide you with a down payment and subsequently make regular monthly payments until the property is fully paid off, at which point ownership is transferred to them. It is crucial to prioritize your legal protection and compliance with federal, local, and state laws throughout this process. Engaging the services of a qualified real estate attorney is highly recommended to ensure that your rights are safeguarded. They will guide you in navigating the legal intricacies associated with seller financing, provide valuable advice, and ensure that all necessary legal obligations are met. Should you require assistance in finding a reputable real estate attorney, feel free to reach out to us, and we will gladly make an introduction for you.

Step 3. Market your house online and offline

Once you have all the necessary paperwork in order, it’s time to start promoting your house for sale, emphasizing the availability of seller financing. It is crucial to proactively communicate to potential buyers that this financing option is offered. When it comes to marketing, there are no limits to the extent of your efforts; in fact, the more extensive your marketing endeavors, the greater the chances of attracting interested parties.

Ensure that your marketing strategy is multifaceted and encompasses various channels to maximize visibility. Leverage both online and offline platforms, including real estate websites, social media platforms, local classifieds, print advertisements, and word-of-mouth referrals. Highlight the benefits of seller financing, such as increased accessibility for buyers who may not qualify for traditional loans and the potential for a more streamlined purchasing process.

Consider utilizing professional photography and virtual tours to showcase the property’s best features, creating an appealing visual presentation for prospective buyers. Additionally, craft compelling descriptions and emphasize the advantages of your seller financing option, such as flexible terms or lower down payment requirements.

Remember, the goal is to reach as many potential buyers as possible, so explore various marketing avenues and continuously evaluate and refine your strategies based on their effectiveness. By investing time and effort into robust marketing initiatives, you can significantly increase your chances of attracting qualified buyers who are interested in your property and its unique seller financing opportunity.

Step 4. Work with potential buyers

As your marketing efforts start generating interest from potential buyers, it’s time to collaborate with them and schedule house showings. Take the opportunity to personally guide them through your property, highlighting its appealing features and answering any questions they may have.

When someone expresses interest and makes an offer on your house, it’s important to engage in negotiations regarding the price and terms of the transaction. This stage allows both parties to find common ground and reach a mutually beneficial agreement. By actively communicating and considering each other’s perspectives, you can aim for a win/win situation that satisfies both you as the seller and the buyer.

Once negotiations are successfully concluded, it’s time to proceed with signing the necessary paperwork. This step formalizes the agreement between you and the buyer, solidifying the terms and conditions of the sale. It is essential to ensure that all pertinent details are accurately documented to protect both parties and provide a clear framework for the transaction.

By actively engaging in the negotiation process and finding a middle ground that addresses the interests of both parties, you can reach a satisfactory agreement. Once the paperwork is signed, you can proceed with confidence, knowing that you have successfully navigated the negotiation process and are one step closer to finalizing the sale of your house.

Step 5. Collect the down payment and hand over the keys

After reaching an agreement on the price and completing the necessary paperwork, it’s time to proceed with collecting the down payment from the buyer and officially handing over the keys. In the majority of cases, you, as the seller, will retain ownership of the house, while the buyer will commence making regular payments towards the outstanding balance. Ownership of the property will transfer to the buyer upon full repayment of the agreed-upon amount.

Once the down payment is received, it signifies the buyer’s commitment to the purchase. At this point, you can finalize the transfer of possession by providing them with the keys to the property. It is crucial to ensure that all financial transactions and documentation are conducted in compliance with legal requirements and that you maintain a record of the payments received.

Over the course of the agreed-upon payment schedule, the buyer will continue to make regular monthly payments to you, gradually reducing the outstanding balance. As each payment is made, you, as the seller, will retain ownership of the house while serving as the mortgage holder.

It is important to adhere to the terms of the seller financing agreement and maintain open lines of communication with the buyer throughout the payment period. As the buyer fulfills their financial obligations, you can track the progress of the payments and maintain accurate records to ensure a smooth transition of ownership when the house is fully paid off.

Ultimately, once the buyer has completed the payment schedule and fulfilled their financial obligations, ownership of the property will transfer from you, the seller, to the buyer, marking the successful conclusion of the seller financing arrangement.

If you’re wondering how to sell a house by owner financing in Butte County , we can help. We might be able to offer you some advice or even work out an owner financing arrangement where we buy your house from you. Talk to our team at (530) 230-3560 or by clicking here to fill out the form.

- How To Set Your Asking Price When Selling a Home in Butte CountyWhen selling your home in Butte County, you will obviously want to get a great price for it. However you don’t want to price too high, and scare off potential buyers, nor do you want to price too low, losing … Continued

- 4 Staging Tips To Help You Sell Your House Fast In ParadiseWhen aiming to sell your house fast in Paradise, effective staging is crucial to create an environment that captivates potential buyers. Begin by decluttering and depersonalizing the space, allowing visitors to easily envision themselves in the home. Incorporating simple yet … Continued

- 3 Ways To Appeal To Buyers in OrovilleSetting the right asking price for your Oroville home is a foundational step to generate interest. Extensive market research and a realistic understanding of your property’s value are essential in this process. A strategic pricing strategy not only attracts potential … Continued

- Pros and Cons of an Open House When Selling Your Home In Butte CountyDeciding whether to host an open house when selling your Butte County home involves weighing several factors. On the positive side, open houses can increase exposure by attracting a wider range of potential buyers and creating a sense of competition … Continued

- Negotiation Tips for Selling Your Home in ReddingAre you contemplating selling your Redding house? Prior to listing it or attempting to sell it independently, it’s crucial to establish your negotiation strategy. Being prepared and proactive can give you an edge in your negotiations with potential buyers. Utilize … Continued